1 What Is Law and Economics?

Law is an ideal subject for economists to study because it provides a wealth of material for evaluating theories of rational behavior. The most creative researcher could not imagine the variety of situations that even a casual examination of legal disputes reveals.

Another reason that economists study law is that both disciplines are concerned, to varying degrees, with incentives. Rational decision makers in economics act to further their self-interest subject to the constraints that they face. Ordinarily, we think of individuals making economic decisions in the context of markets, subject to market prices and incomes, but nonmarket decisions can also be analyzed from an economic perspective. Indeed, the explanatory power of economics is most clearly illustrated in these interdisciplinary contexts.

The economic approach to law assumes that rational individuals view the threat of legal sanctions (monetary damages, fines, prison) as implicit prices for certain kinds of behavior, and that these prices can be set to guide behavior in a socially desirable direction. More than one hundred years ago, the most famous American judge and legal scholar, Oliver Wendell Holmes, set forth a theory of law that well reflects (one might say, anticipates) the economic approach to law described in this book.1 The theory is sometimes referred to as the prediction theory of law.

The key figure in Holmes’s theory is the “bad man,” who we will see has much in common with the rational decision maker of economic theory. The bad man is not bad in the sense that he consciously sets out to break the law; rather, he is a rational calculator who seeks to stretch the limits of law and will break it without remorse if the perceived gain exceeds the cost. Thus, the bad man has a strong interest in knowing what the law is and what the consequences of breaking it are: “If you want to know the law and nothing else, you must look at it as a bad man, who cares only for the material consequences which such knowledge enables him to predict” (Holmes 1897, 459). The economic model of law does not focus on the bad man because economists think people are basically amoral. Many, perhaps most, people obey the law out of a sense of rightness and therefore are not affected by legal rules at the margin. (Such a person will not commit a crime regardless of the chances of being caught or how long or short the prison term might be.) Thus, to examine the incentive effects of law—that is, to examine how it affects behavior at the margin—we must focus on those to whom it is a binding constraint. Nevertheless, we will see that most people respond to the law in this way in at least some circumstances. For example, even people who would not consciously commit a crime regardless of the threat of punishment make decisions while engaging in risky activities (such as driving a car) that potentially subject them to tort liability (or even to criminal fines for speeding).

1.1 Positive and Normative Analysis

Economic analysis of the law comes in two varieties: positive and normative analysis. Positive analysis seeks to explain how people respond to the threat of legal sanctions by posing questions such as the following: Will longer prison sentences deter more crime? How will changes in tort rules affect the accident rate? Or more controversially: Does the death penalty reduce the murder rate? How would restrictions on gun ownership affect the crime rate? Positive analysis thus relies on the assumption that people respond to the law in this manner.

Positive analysis sometimes goes further, however, to assert that legal rules tend to reflect economic reasoning; in other words, efficiency is a social goal that is actually reflected in the law.2 This is not a claim that judges and juries consciously undertake economic calculations to determine the best ruling in individual cases. Rather, it is a conjecture about the overall tendency of judge-made law (referred to as the common law) to reflect economic efficiency as an important social value. This assertion is somewhat controversial, especially among traditional legal theorists who view the law as being mainly concerned with justice (however that is defined). Hopefully, however, the analysis in this book will convince you that the efficiency hypothesis has some validity.

In contrast to positive analysis, normative analysis asks how the law can be improved to better achieve the goal of efficiency. It is like asking how the health care or education system can be made more efficient. This type of analysis relies on the assumption that efficiency is a goal that the law should reflect, and that legal rules should be changed when they fail to achieve it. In some cases this is uncontroversial, as with proposals aimed at improving the efficiency of the litigation process, but the general assertion that efficiency is a social value that the law should promote is not so universally accepted.

The analysis in this book will combine positive and normative analysis. It will focus on positive analysis because that has been the thrust of most recent scholarship in the field. But in cases where the law seems to fall short of efficiency, we will propose better alternatives.

1.2 Is Efficiency a Valid Norm for Evaluating Law?

As noted, critics argue that it is inappropriate to judge laws on the basis of economic efficiency. Instead, they urge that the law should pursue goals like fairness and justice. These are vague terms, but one common meaning has to do with the distribution of wealth in society (distributive justice), and economics surely has something to say about how a just distribution can be achieved with the least sacrifice in resources. Still another meaning of justice may simply be efficiency. In a world of scarcity it is “immoral” to waste resources, and the law should therefore be structured to minimize such waste, at least so that it does not conflict with other goals (Posner 1998a, 30).

Kaplow and Shavell (2002) have argued that social welfare, defined as the aggregation of some index of the well-being of all individuals in society, should be the sole basis for evaluating legal policy. According to this argument, notions of fairness should not influence policy except to the extent that they enhance people’s well-being (which would be true if people have a “taste” for fairness). At the same time, they assert that narrow concepts of efficiency (such as wealth maximization) are also inappropriate because they exclude factors that may affect well-being (for instance, the distribution of wealth).

Nevertheless, they suggest that as a practical matter, efficiency may often be the best proxy for welfare in evaluating specific legal rules. This is especially true of legal questions that are explicitly economic. For example, breach-of-contract remedies should be structured to maximize the gains from trade, and laws governing property disputes should promote bargaining and internalize externalities. However, readers will no doubt object to the use of efficiency alone (or at all) in other contexts (for example, in criminal law), or will see it as too narrow (for example, in medical malpractice cases or environmental accidents). Even the staunchest adherents of the economic approach to law understand this. But it should not deter us from applying economic logic to these contexts to see what insights it might yield, while remaining mindful of competing goals.

2 Efficiency Concepts

The economic approach to law is based on the concept of efficiency. It is therefore important to be specific about exactly what that means. The basic definition of efficiency in economics is Pareto efficiency, but there are other definitions as well.

2.1 Pareto Efficiency

Consider a society consisting of two individuals and a fixed level of goods and services to be distributed between them.3 Define an allocation to be any such distribution. The allocations that we call Pareto efficient (or Pareto optimal) are “best” among all possible allocations in the sense that they satisfy the following two definitions. First, an allocation A is said to be Pareto superior to another allocation B if both individuals are at least as well off under A as compared to B, and at least one is strictly better off. Note that this is a criterion for making pairwise comparisons of different allocations. It merely requires that the two individuals be able to evaluate their welfare (or utility) under any two bundles and decide whether they are better off under A, better off under B, or indifferent between them. Second, an allocation A is said to be Pareto efficient (or Pareto optimal) if there exists no other allocation that is Pareto superior to it.

Note that this definition of Pareto efficiency has the appealing feature that it achieves unanimity in the sense that reallocations are allowed only if neither party is made worse off. In other words, any changes consistent with Pareto superiority should be consensual, meaning that all individuals should agree to them (or at least not seek to block them).4

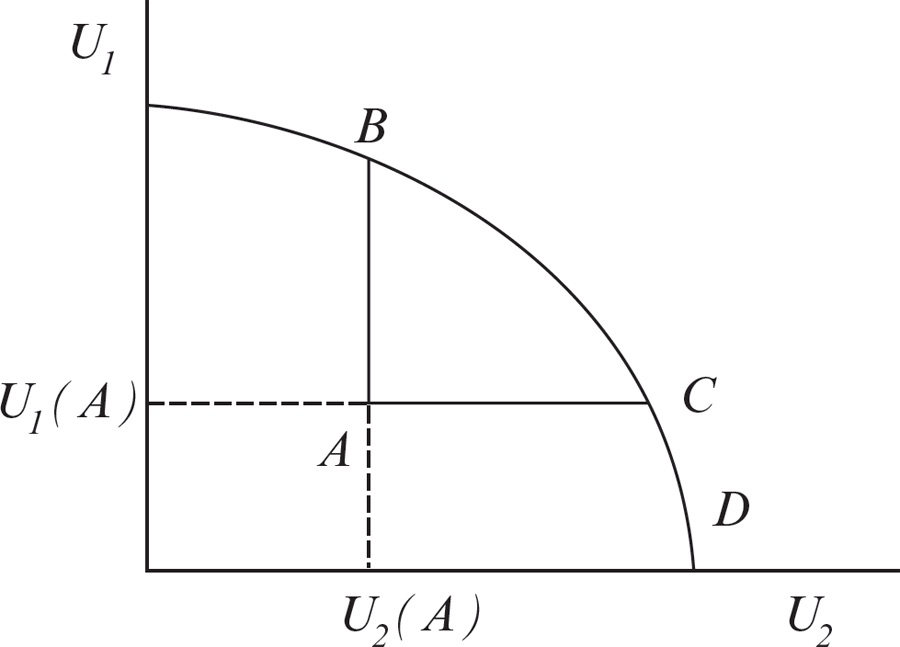

Pareto efficiency does, however, have two rather unappealing features. First, it does not necessarily lead to a unique allocation. In fact, an infinite number of allocations may satisfy the definition, even in our two-person world. This can be seen by looking at Figure 1.1, which graphs the utility possibility frontier for the two individuals in the economy. The utility of an individual is simply an index of his or her satisfaction given any allocation of goods and services. This index allows individuals to make comparisons for the purpose of applying the criterion of Pareto superiority.

The negatively sloped curve defines a region that contains all feasible levels of utility for the two individuals, given the fixed level of goods and services available. Points on or inside the frontier represent all feasible allocations. Consider an arbitrary initial allocation inside the frontier, labeled A. Starting at this allocation, we can use the criterion of Pareto superiority to define the area ABC, which contains all of the allocations that are Pareto superior to A. For example, if the utility of person two were fixed at U2(A), then the set of allocations that are Pareto superior to A would be those on the line segment AB since they yield person one at least as much utility as she gets at A while making person two no worse off. The same applies to person two if person one’s utility were fixed at U1(A). Points inside area ABC obviously make both people better off than at A. Thus, point A cannot be Pareto efficient.

The Pareto efficient points in this example are those on the line segment BC since there is no feasible reallocation that can make both people better off. The only possible movement is along the segment, which makes one person better off but the other worse off. Such movements, however, cannot be evaluated according to the Pareto superiority criterion. We therefore say that Pareto efficient points are noncomparable with each other; that is, the criterion of Pareto efficiency has no way of ranking them.

The second unappealing feature of Pareto efficiency can be seen by comparing points A and D. Note that point D is Pareto efficient and point A is not, yet they are also noncomparable: moving from A to D makes person two better off and person one worse off, while movement from D to A has the reverse effect. The reason for this problem is that the definition of Pareto efficiency depends on the initial allocation, or starting point.

These weaknesses of Pareto efficiency, both of which have to do with noncomparability, are significant because most (if not all) interesting questions of legal policy concern changes that help one group of individuals while hurting others. For example, more-restrictive gun laws hurt legal gun owners but may help victims of gun accidents or violence, and more-liberal liability rules for product-related accidents help consumers of dangerous products but hurt manufacturers and their workers. This suggests that Pareto efficiency is not a workable criterion when it comes to evaluating proposed changes to actual legal rules. (In addition, Pareto optimality permits very unequal distributions of income.)

2.2 Potential Pareto Efficiency, or Kaldor-Hicks Efficiency

Economists often address this noncomparability problem by employing a relaxed notion of the Pareto criterion referred to as potential Pareto efficiency, or Kaldor-Hicks efficiency. To describe this concept, notice that movements from B to C (or from A to D) in Figure 1.1 could satisfy the Pareto criterion if person two (the gainer) is made sufficiently better off by the move that he would be able to fully compensate person one (the loser) and still realize a net gain. For example, suppose that the movement from A to D yielded person two an increase in wealth of $500 but cost person one $400. Person two would thus still enjoy a net gain of $100 after compensating person one, and the outcome would be Pareto superior to point A.

Of course, it is not practical to arrange such compensation in the case of actual changes—imagine how this would be done, for example, in the case of the enactment of stricter automobile safety standards, or health care reform—but the fact that it could be done in theory suggests that point D is more efficient than point A. Movements for which full compensation is possible in the sense that gainers gain more than losers lose, but for which compensation is not actually paid, are said to be Kaldor-Hicks efficient. (If compensation were paid, the move would be truly Pareto efficient.)5

Note that Kaldor-Hicks is therefore based on cost-benefit analysis—changes in policy or law are efficient if gains exceed losses.6 It is also consistent with the goal of wealth maximization in that changes that satisfy the Kaldor-Hicks criterion must increase aggregate wealth by the difference between benefits and costs. Thus, if all possible changes dictated by Kaldor-Hicks were made, aggregate wealth would be maximized. Most of our analysis of the impact of actual legal rules in this book will involve wealth maximization. In some cases, such as in our analysis of the various tort rules, this will entail minimizing costs (specifically, the cost of risky activities), while in other cases, such as contract rules, it will involve maximizing gains from trade.

As a final point, note that the general principle underlying Kaldor-Hicks efficiency, whether it involves cost minimization or surplus maximization, is marginal analysis. According to this principle, an outcome is optimal when the marginal gains from the activity in question equal the marginal costs. For example, in the case of risky activities, expected costs are minimized when the parties engaged in the activity invest in precautionary behavior up to the point where the last dollar spent on safety measures equals the expected dollar savings in accident costs. Our analysis of tort law will examine the extent to which the various rules for assigning liability, such as negligence law, actually induce parties to behave in this way.

2.3 Consensual Versus Nonconsensual Exchange

Although Kaldor-Hicks gets around the problem of noncomparability under Pareto efficiency, it has the disadvantage that we cannot claim that changes are consensual since there are actual losers. This reflects an important trade-off that will arise throughout this book. On one hand, consent guarantees mutual gains, which is the basis for the efficiency of competitive markets, and is satisfied under Pareto efficiency. On the other hand, when markets fail as the result of some sort of externality such as pollution, not all gains from trade will be exploited. An important economic justification for government intervention in markets (including the creation of legal obligations) is therefore to correct market failures.

But such intervention will nearly always create winners and losers. However, the hope is that those who lose from one policy will benefit from others and that on net, everyone will gain as aggregate wealth is increased. That is, as the overall size of the pie expands, the average slice will increase. In this way, one can argue that implied consent for the use of the Kaldor-Hicks criterion replaces actual consent under Pareto.

The economic approach to law as examined in this book will focus primarily on judge-made law rather than statutory or constitutional law (though we touch on constitutional issues at various points). One reason is that the preceding argument is more compelling for common law because judges are, for the most part, insulated from the political process and hence less likely to be influenced by special interests. This minimizes the risk that there will be systematic losers in the legal process.

3 The Coase Theorem

The role of legal rules in restoring efficiency in the presence of market failure was critically examined in a seminal article by Ronald Coase.7 Prior to Coase, the prevailing view among economists was that externalities such as pollution could be internalized only by means of government intervention, for example, by imposing financial liability (a tax or fine) on the polluter. But Coase’s analysis changed that by emphasizing the role of bargaining and transaction costs in determining the ultimate allocation of resources against the background of legal rules.

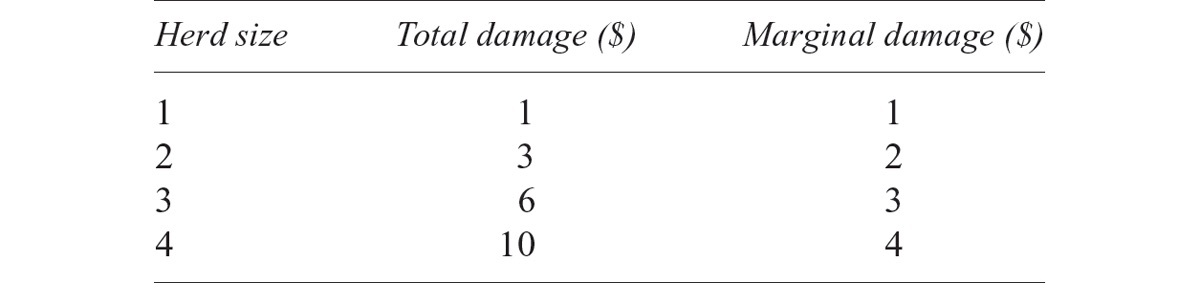

Coase’s basic insight is best illustrated by means of one of his simple numerical examples. Consider two adjacent parcels of land, one owned by a farmer and one owned by a rancher. The problem is that the rancher’s cattle sometimes stray onto the farmer’s land, causing crop damage. Table 1.1 shows the farmer’s total and marginal damages (in dollars) as a function of the rancher’s herd size.

TABLE 1.1 Farmer’s Crop Damage as a Function of Rancher’s Herd Size

Suppose that the marginal benefit to the rancher (marginal revenue minus marginal cost) of each additional steer is $3.50. Thus, the joint value of ranching and farming is maximized at a herd size of three. This is true because for each steer up to three, the increment in profit from ranching exceeds the additional cost in terms of crop damage. However, for the fourth steer, the incremental gain is less than the cost. A single individual who owned both the ranch and the farm would therefore choose a herd size of three because she would internalize both the benefit of additional steers and the damage to crops. With separate owners, however, we might expect the rancher to ignore the crop damage and expand his herd to four (the maximum possible size). This belief provides the basis for government intervention to force the rancher to internalize the farmer’s loss, for example, by means of a tax on ranching or by allowing the farmer to file a nuisance suit for damages.

But let us consider more carefully the case where the rancher is not held legally responsible for the farmer’s loss. In the absence of liability, the rancher can add the fourth steer for a profit of $3.50, while ignoring the additional $4 in damages that the farmer must bear. But suppose that the farmer and the rancher can bargain, and the farmer offers to pay the rancher, say, $3.75 not to add the fourth steer. The rancher will accept the offer because it yields a greater incremental profit than he would have earned from the steer, and the farmer is better off because she saves the damage of $4 by spending $3.75. Further deals are not possible because the marginal damages from the first three steers are less than their value in ranching. The herd thus ends up at the efficient size of three, even though the rancher is not required to pay for the farmer’s damage. (In fact, he is paid not to add the fourth steer.)

EXERCISE 1.18

Suppose in the preceding example that crop damage from straying cattle can be entirely eliminated by fencing in the farmer’s land at an annual cost of $9. Show that the optimal herd size is now four, and that this outcome will be achieved regardless of whether the rancher or the farmer is legally responsible for crop damage (assuming that the parties can bargain).

The preceding analysis shows that when bargaining is possible, the efficient outcome can always be achieved by private agreements between the parties to an externality, regardless of how the law assigns liability. In other words, whether or not the rancher is liable for crop damage, the herd size will be the same. This surprising conclusion turns out to be quite general and hence has come to be known as the Coase Theorem. The Coase Theorem, as we will see, has far-reaching implications for the economic analysis of law. We point out two of these implications here. (We examine the Coase Theorem in more detail in Chapter 7, Section 1.2.)

First, the Coase Theorem implies that the social goals of efficiency and distributional justice are not necessarily incompatible, as is often assumed. To see this, note that in the preceding example, although the herd size was invariant to the assignment of liability, the distribution of income was not. Specifically, when the rancher was liable for crop damage, he had to make damage payments to the farmer, whereas when the rancher was not liable, the farmer had to pay the rancher to keep the herd size from expanding beyond the efficient level. Thus, variations in the assignment of liability can be used to alter the distribution of wealth without affecting the allocation of resources.9 This suggests that when the conditions of the Coase Theorem are met, judges can pursue the goal of distributional justice without worrying about sacrificing efficiency.

But how likely is it that the conditions of the Coase Theorem will be met? It depends on the cost of bargaining between the parties to an externality. If these costs are high, as they often will be (especially when large numbers are involved), then private agreements are unlikely, and the rule for assigning liability will dictate the final allocation of resources. This leads to the second important implication of the Coase Theorem: When bargaining costs are high, the rule for assigning liability matters for efficiency (Demsetz 1972). Although this conclusion may seem obvious, it has important consequences for the nature of legal rule making. In particular, it bears on the fundamental question of whether to structure laws in the form of inflexible rules that dictate certain conduct or consequences irrespective of circumstances, or whether to leave some discretion so that judges can tailor outcomes to individual cases. In his classic treatise on the concept of law, Hart (1961, 127) framed the choice in this way:

In fact all systems, in different ways, compromise between two social needs: the need for certain rules which can, over great areas of conduct, safely be applied by private individuals to themselves without fresh official guidance or weighing up of social issues; and the need to leave open, for later settlement by an informed, official choice, issues which can only be properly appreciated and settled when they arise in a concrete case.

An example of this in the area of tort law is the choice between strict liability, which holds injurers liable for any damages that they cause, and negligence, which holds them liable only if they failed to take “reasonable care,” where reasonableness has to be judged on a case-by-case basis.

The advantage of rules is that they are predictable and hence allow individuals to plan for the consequences of their actions. This is highly desirable when markets function well and there are few impediments to private bargaining. In this low-transaction-cost world, the role of the law is minimal—it is limited to the delineation of rights and the enforcement of contracts. The fact that rules are inflexible to specific circumstances does not result in inefficiency because, as we have seen, the allocation of resources is invariant to legal rules due to Coasian bargaining. But this world is of limited relevance for most problems confronting the law. More pervasive is the existence of situations involving high transaction costs, which prevent parties from bargaining around inefficient rules and from resolving disputes without legal intervention. In this more realistic setting, the law matters for efficiency, so rules must give way to standards that allow discretion on the part of judges to balance costs and benefits in individual cases. This realm will receive most of our attention in this book.

4 The Law in “Law and Economics”

The system of law in the United States is largely inherited from England. In this so-called common-law system, there are three primary sources of law. The first is the Constitution, which sets out the basic structure and duties of the government, as well as certain fundamental rights of citizens. The second is the legislature, which is made up of elected representatives who enact laws reflecting the “will of the people.”10 (The executive branch of government is primarily charged with carrying out the laws enacted by the legislature, but it also has some limited lawmaking ability.)

Finally, the judiciary enacts laws as a by-product of its role in resolving legal disputes. These laws take the form of legal “precedents,” and the accumulation of precedents constitutes what is known as the common law. Economists typically study this body of judge-made law under the heading of “law and economics.”11

4.1 The Nature of the Common Law

Common-law rules (precedents) arise out of decisions by appeals courts and are binding on lower (trial) courts in future, similar cases. (See the discussion of the court system that follows.) Precedents are valuable to society, as we have seen, because they provide information to people about the consequences of their actions. This information allows them to make rational decisions in settings that might entangle them in legal disputes, as when they engage in risky activities, enter into contracts, or plan to develop property.

At the same time, the law must be adaptable to changing circumstances. The common-law process permits this by allowing judges to alter or overturn precedents in the presence of new information. A central theme of the economic analysis of law (a component of positive analysis), and one that pervades this book, is that the common law tends to display an economic logic. This assertion is not based on a claim that judges consciously act to promote efficiency (though they sometimes do, the most famous example being Judge Learned Hand’s formula for a negligence standard in United States v. Carroll Towing Co., discussed in Chapter 2).12 Nor is it a claim that all common-law rules are efficient at any point in time. Rather, the argument is that there are forces inherent in the common-law process that propel it in the direction of efficiency.13 The idea is similar to the invisible hand theorem of market efficiency first proposed by Adam Smith and later formally proved as the first fundamental theorem of welfare economics.

4.2 The Court System in the United States

As a preface to our analysis of specific areas of the common law, it will be useful to provide an overview of the institutional structure of the court system in the United States.14 The structure of courts at both the state and federal level is hierarchical. At the lowest level are the trial courts, which have general jurisdiction. That is, they hear a wide range of cases on both civil and criminal matters. At the state level, these courts (commonly called district or circuit courts) are organized according to counties. At the federal level, they are organized into ninety-four judicial districts (so-called district courts), with at least one district court in each state, depending on the volume of business, and one in the District of Columbia.15

At the next level are intermediate appellate courts, whose responsibility is to hear appeals from the trial courts and to uphold, reverse, or modify those decisions. Not all states have these intermediate courts (in which case the single appeals court is the state’s highest, or supreme, court), but all federal districts do. At the federal level, appeals courts are organized into twelve regional circuits, each covering several states. These courts hear appeals from district courts within their circuits, as well as appeals from federal administrative agencies. There is also a Court of Appeals for the Federal Circuit in Washington, D.C., which hears appeals from cases involving patent laws and cases decided by the Court of International Trade and the Court of Federal Claims. Unsuccessful litigants always have the right to have their appeals heard by these intermediate courts, provided that they are willing to pay the costs.

Of course, the highest court in the federal system is the Supreme Court of the United States. It is composed of nine justices, appointed for life by the president. Unlike intermediate appellate courts, the Supreme Court, as well as the highest courts in the states, has discretion over the cases it will hear. If the highest court declines a case, it simply means that the ruling at the previous level stands. For practical reasons, the Supreme Court can hear only a small fraction of cases submitted for review. It therefore selects only those cases that involve a new or pressing issue. In addition to appeals from federal appellate courts, the U.S. Supreme Court occasionally hears appeals from state supreme courts.

There are rules that dictate the jurisdiction of courts. The jurisdiction of state courts is typically limited to disputes between residents of that state, while the jurisdiction of federal courts is dictated by Congress based on powers granted to it by the Constitution. Most federal district court cases fall into one of three categories: cases involving a “federal question” (cases arising under the Constitution, federal law, or treaties), cases involving citizens of different states (“diversity of citizenship” cases), or cases where the United States is a party (usually criminal cases). Federal courts generally apply the law of the state in which they are located.

As noted, Supreme Court judges are appointed for life by the president (with oversight by the Senate), as are federal appeals court judges. The manner of selecting state court judges varies by state, but most are elected for a limited term.

5 Conclusion

This chapter began with an introduction to the study of law and economics and discussed several key issues that will figure prominently in the following chapters. Chief among these was the question of whether efficiency is a valid norm for evaluating legal rules and institutions. The normative economic theory of law says that it is (possibly in conjunction with other norms), while the positive theory goes further to contend that the common law often embodies an economic logic. This book will examine both of these branches of law and economics.

After discussing various efficiency concepts (and settling on Kaldor-Hicks, or wealth maximization, as the most workable), we introduced the Coase Theorem, perhaps the most important building block in the economic approach to law. We will use the insights embodied in this theorem throughout the book. The chapter concluded with an overview of the nature of the common law and the legal system in the United States.

DISCUSSION QUESTIONS

1. Describe the sense in which Holmes’s “bad man” corresponds to the rational decision maker of economic theory.

2. Under the law of negligence, individuals engaged in activities that may cause harm to others (external harm) are expected to take precautions that a “reasonable person” would take in the same circumstances. How does the reasonable person of negligence law relate to the rational decision maker of economics?

3. It is often said that efficiency and fairness are incompatible objectives for an economic system. Explain why this is not true when the conditions of the Coase Theorem are met.

PROBLEMS

1. Suppose a law is passed that prohibits farmers from using certain chemical fertilizers because they contaminate ground water. The expected reduction in illness to water users is $10 million, but the loss to farmers is $8 million.

(a) Is the law Pareto superior to the status quo? Is it a Kaldor-Hicks improvement? Explain.

(b) Now suppose the government taxes water users and uses the revenue to fully compensate farmers for their losses. Is the law now a Pareto improvement? Is it a Kaldor-Hicks improvement? Explain.

2. Suppose there are three mutually exclusive groups in a particular state: timber company shareholders, environmentalists, and neutral parties. The numbers of each are as follows:

The total profit from logging is $8,000, which is evenly divided among shareholders. Environmentalists wish to stop all logging and are willing to pay $25 each to do so. Neutral parties are uninterested in this debate.

(a) Is a law banning logging Pareto optimal? Is it Kaldor-Hicks efficient?

(b) Suppose that owners of the timber company would be fully compensated if logging were prohibited, but this would require raising tax revenue of $8,000 and paying it to shareholders. For each of the following scenarios, state whether a law banning logging, coupled with compensation, is Pareto optimal, and whether it is Kaldor-Hicks efficient:

(i) The tax is assessed equally on both environmentalists and neutral parties;

(ii) The tax is assessed only on environmentalists.

3. The case of Sturges v. Bridgman (11 Ch.D. 852, 1879) involved a confectioner who had operated heavy machinery at a certain location for several years as part of his candy-making business. When a doctor built a consulting room directly against the confectioner’s premises, however, he found that the noise and vibration were a disturbance to his practice. He therefore sought an injunction to prevent the confectioner from using the machinery. Suppose it would cost the confectioner $150 to move his machinery to a location where it would not disturb the doctor, and it would cost the doctor $200 to relocate the consulting room.

(a) Assume that the doctor and confectioner can bargain costlessly. What will be the outcome if the court grants the injunction? What if it does not grant it?

(b) How would your answer to (a) change if the parties cannot bargain?

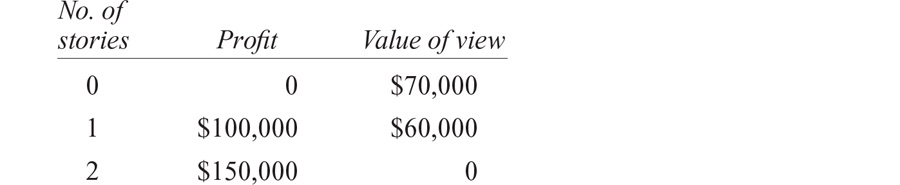

4. The owner of a house has an unobstructed view of the ocean from his front window. However, the owner of a vacant lot in front of the house announces plans to build a house of his own. Suppose that a one-story house will partially obstruct the view, but a two-story house will block it completely. The builder’s profit and the value of the owner’s view are shown in the following table:

(a) Is it efficient for the house to be built? If so, how many stories should it be? Suppose the original owner seeks an injunction halting construction.

(b) Describe the bargaining between the builder and the owner if the court refuses to grant the injunction.

(c) Suppose the court grants the injunction. Can the builder bribe the owner not to enforce it?

1. Holmes (1897). We will encounter Holmes throughout the book.

2. The foremost proponent of this view is Posner (2003).

3. The determination of how these goods and services are produced from the available resources is based on the productive efficiency of the economy. Here, we focus on exchange efficiency, taking the level of goods and services as given.

4. This assumes that people are not motivated by envy, which might cause some to object to changes that benefit others even if they themselves are not hurt.

5. See Coleman (1982) for a comparison of the Pareto and Kaldor-Hicks concepts of efficiency.

6. See chapter 3 of Posner (2001) for an examination of cost-benefit analysis as a means of evaluating social policy.

7. Coase (1960). Many date the origin of modern law and economics to the publication of this article, which is undoubtedly the most cited in the law and economics literature.

8. The answers to in-chapter problems are contained in the back of the book.

9. This conclusion is closely related to the Second Fundamental Theorem of Welfare Economics.

10. Few laws are voted on directly by the people, which makes the United States a representative democracy, or a republic, rather than a true democracy.

11. Economists have also studied the process of lawmaking by legislatures as part of the field of public choice (the classic reference is Buchanan and Tullock [1962]), and they have also begun to develop an economic theory of constitutional law (Cooter 2000). We will encounter some aspects of constitutional law in Chapters 7 and 9.

12. 159 F.2d 169 (2d Cir. 1947). This citation shows how lawyers refer to cases in law reporters. The first number, 159, refers to the volume of the reporter; F.2d refers to the series of the reporter—in this case, it is the Federal Reporter, second series; the second number, 169, is the first page of the written opinion; and the information in parenthesis is the court (here, the Second Circuit) and year in which the case was decided.

13. This argument is presented and evaluated in Chapter 9.

14. This discussion is based on Mermin (1982, 58–60 and 166–69).

15. There is also one each in Puerto Rico, the Virgin Islands, the Northern Mariana Islands, and Guam.